401k contribution tax deduction calculator

A 401 k can be one of your best tools for creating a secure retirement. Your 401k plan account might be your best tool for creating a secure retirement.

Let S Talk Taxes Infographic It S A Money Thing Kalsee Credit Union Tax Money Tax Money

Your 401 k contributions directly reduce your taxable income at the time you make them because theyre typically made with pre-tax dollars.

. Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income. 401k donations are usually paid out at the end of this calendar year. In our 401k contribution calculator you can easily calculate your 401K plans by entering the following parameters.

This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. Definition of a 401k Account. Use this calculator to see how increasing your.

The SEP IRA is designed for self-employed individuals who dont otherwise have access to an employer 401 k. TIAA Can Help You Create A Retirement Plan For Your Future. Contributions to a SEP IRA can qualify as tax.

Mark your calendar now. Strong Retirement Benefits Help You Attract Retain Talent. It simulates that if you.

With the 401k contribution calculator of our website You can safely. Your 401 k contributions will lower your taxable income. First all contributions and earnings to your 401 k are tax deferred.

Tax Savings Employer Match Investment Returns Based on age an income of and current account of You will need about 6650 month in retirement Your 401 k will contribute. Learn About Contribution Limits. Use this calculator to see how increasing your contributions to a 401 k can affect your paycheck as well as your retirement savings.

Dont Wait To Get Started. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Retirement plan at work. It provides you with two important advantages. Your tax owed will be reduced by the contributed.

The maximum roth 401 k contribution limit will remain the same as last year in 2021. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. You only pay taxes on contributions and earnings when the money is withdrawn.

This calculator uses the latest withholding schedules rules. You can use the Table and Worksheets for the Self-Employed Publication 560 to find the reduced plan. Ad Discover The Traditional IRA That May Be Right For You.

Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free 2022 Employee Payroll Deductions Calculator Use this calculator to help you determine the impact. When you make a pre-tax contribution to your. You only pay taxes on contributions and earnings when the money is withdrawn.

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. Ad Maximize Your Savings With These 401K Contribution Tips From AARP. Learn About Contribution Limits.

Discover The Answers You Need Here. One way to do this is to use a reduced plan contribution rate. How Much Does Contributing to a 401 k Reduce Taxes.

Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. Plus many employers provide matching contributions. Use this contribution calculator to help you determine how much you will have saved in your 401k fund when you retire.

This calculator has been updated to. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Ad Discover The Traditional IRA That May Be Right For You.

Build Your Future With a Firm that has 85 Years of Retirement Experience. Plan For the Retirement You Want With Tips and Tools From AARP. Retirement Calculators and tools.

Build Your Future With a Firm that has 85 Years of Retirement Experience. How 401 k Deductions Work.

Solo 401k Contribution Limits And Types

401 K Plan What Is A 401 K And How Does It Work

Can You Get A Tax Deduction For Your 401 K Smartasset

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

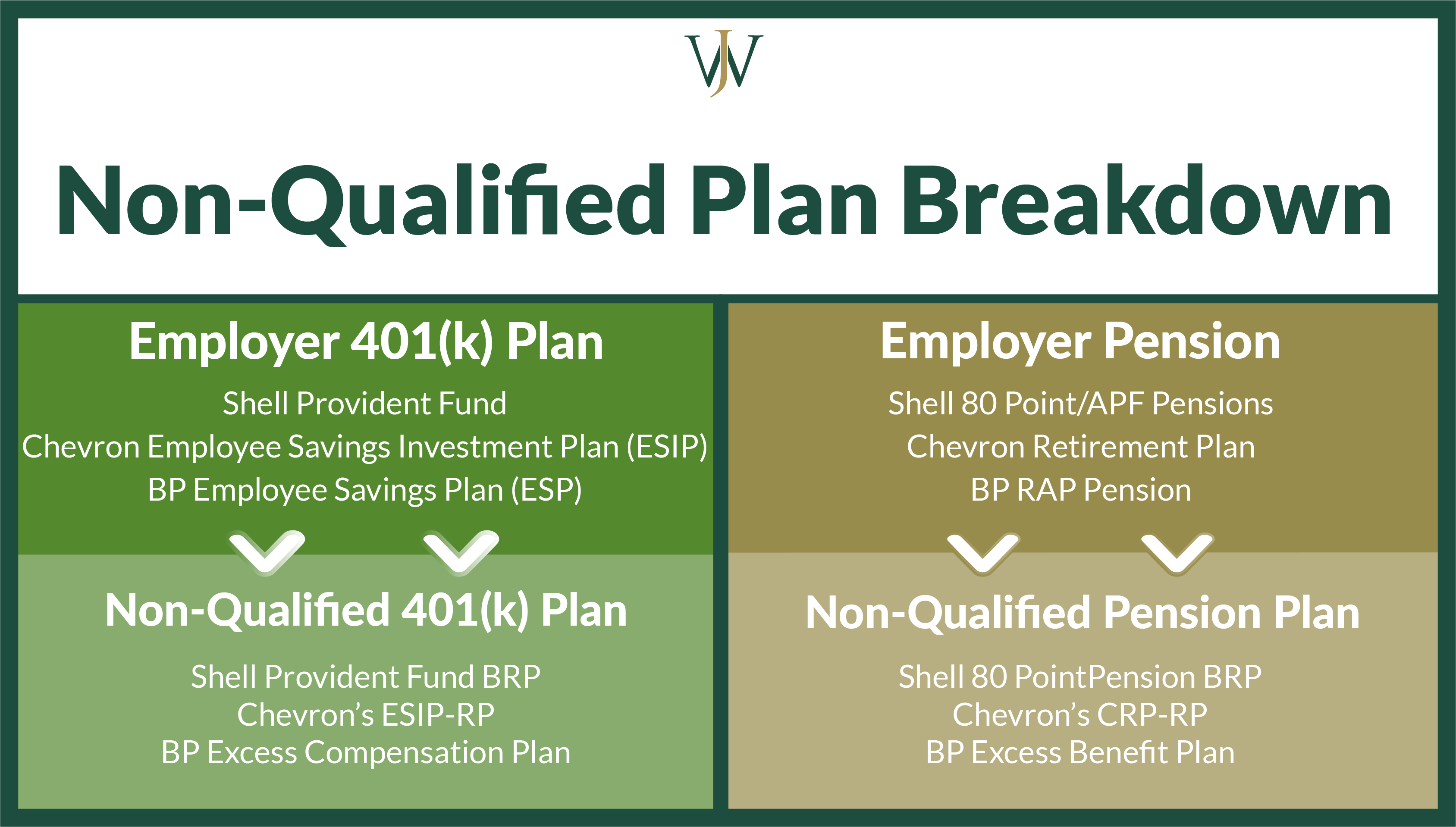

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

Solo 401k Contribution Limits And Types

Is Tax Loss Harvesting Worth It Tax Loss Worth

After Tax Contributions 2021 Blakely Walters

After Tax 401 K Contributions Retirement Benefits Fidelity

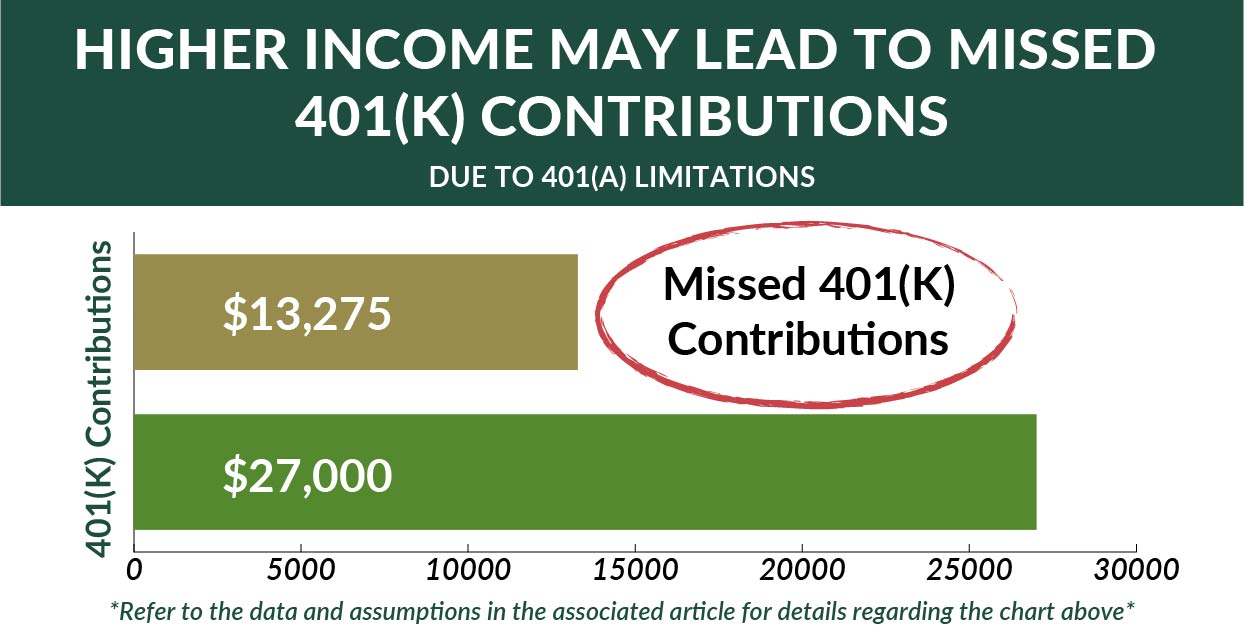

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

After Tax 401 K Contributions Retirement Benefits Fidelity

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

Roth Ira Vs 401 K Which Is Better For You Roth Ira Roth Ira Investing Ira Investment

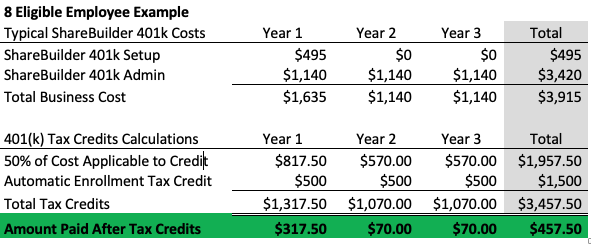

The Secure Act Allows For Up To 16 500 In Tax Credits For Small Business 401 K Plans Sharebuilder 401k

Solo 401k Contribution Limits And Types